Paymetry

There is no platform currently available for financial institutions to identify and monetise opportunity in lending while customers do online shopping. Also communication of offers and deals to customers for driving credit and debit card usage is also sporadic and seasonal. The huge organic traffic on the banks digital properties are not leveraged in a structured manner. Some of the pain points that the financial institutions might face for managing a platform with the above functionalities are below i. Cost: Involves spends in both development and running the platform. This is a non-core area and except for very large banks maintaining a platform will clearly be a drainer ii. Resources: Requires resources from the relevant domain to maintain the platform and again even for bigger banks this will require huge input from their side to maintain customer stickiness and also acquisition. Also for medium sized institutions having vendor tie-ups also will be a great problem because the kind of pull they could have with the vendors will be limited. FTL because of the multiple financial institution partnerships can help them in all these areas iii. Productivity: Vendor and program management will be an on-going process and self-management is not a productive solution in the long run. It will always be better to have a third party with relevant domain expertise to manage the platform iv. Service and assistance: Customers rarely stay invested in a product or service that provides limited support or product assistance. This could manifest if acquisition spend is done but retention is dropping because of customer experience. Here again domain expertise plays a key role and proving service in non-core areas is a huge pain point fro all financial institutions

Website : http://www.ftltechsys.com

Current Status: Early revenues

Business Model: B2B

Product Description

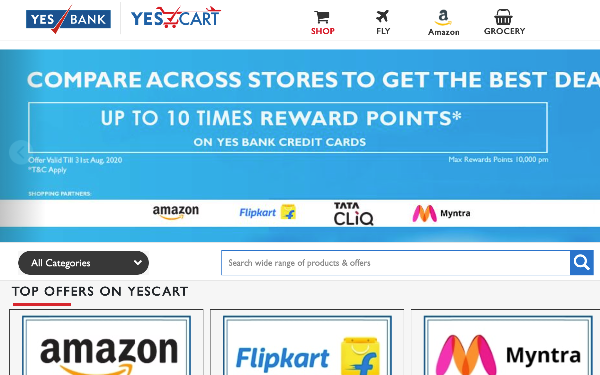

A digital engagement platform focussed on financial institutions which could be de- ployed on their digital channels (website, mobile apps, other channels) with minimal time and efforts. In its core it is designed as a market place which brings together product/ service aggregation, recommendation and analytics into a unified platform. The key objective is to provide intelligent customer engagement which could lead to contextual cross-sell of retail loans and financial products. The platform includes e-commerce, travel, entertainment and other services which covers a customer’s daily life and uses smart recommendation basis customer behaviour to promote the offerings from the financial institution.

The platform is fully customisable basis the client need¬s and has the following key functionalities which aid in cross-sell of retail loans and other offerings

1. White listing and black listing of products and services

2. Open or segmented market place creation. Segments could be customer/ product/ brands/ custom

3. Curation of products and offers

4. Price comparison across major e-com vendors

5. Loan programs created basis the client requirement. Fully customisable - No cost EMI, High tenor, low IRR

6. Rewards, exclusive programs for increasing customer stickiness