PrognoAdvisor

A customer was not able to meet his monthly expenses and loan repayments from his income. He had to borrow because of the shortfall and because of that he could not save also. His data was analyzed and diagnosed that his loans were for shorter terms because of which the EMIs were high. He was advised to consolidate his various loans and take a single loan against property for a longer duration which has substantially reduced the EMIs and generated surplus cash every month. He was also advised to save the surplus towards his various goals. He implemented the advice and is relieved from the issue of cash flow shortage.

Website : https://Prognoadvisor.com

Current Status: Early revenues

Business Model: B2B

Product Description

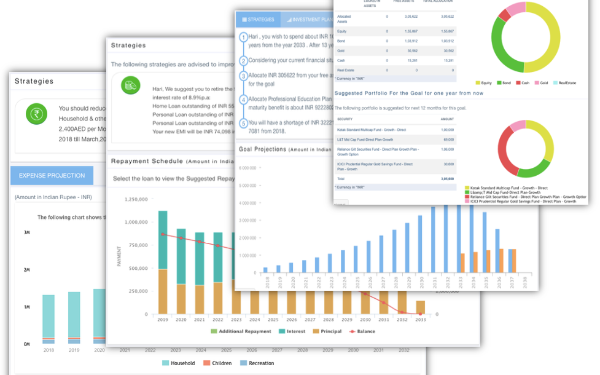

PrognoAdvisor is a digital financial advisory platform that brings together advice seekers, advisors and financial planners. It delivers financial advice to individuals on managing their cash flow, managing their loans, goal planning, investment planning, portfolio rebalancing, life insurance planning, general insurance planning and tax planning. It uses a set of algorithms to organise, analyse, plan and track the financials of an individual.

It is developed using dot net technologies. It has an enterprise architecture. It allows to add any number of customers, advisors, financial planners, advisory managers and has a highly configurable admin module. It helps to generate financial plans 10 time faster than the conventional process and increase advisor efficiency by 4 times. It can receive inputs in any currency and deliver output in any currency preferred. No other financial planning platform provides that facility. It allows a financial planner to set 80+ strategies to generate most practical plan.

PrognoAdvisor can help banks grow their core business of lending as well as increase their fee-based income. It helps corporates to improve the financial wellness of their employees.