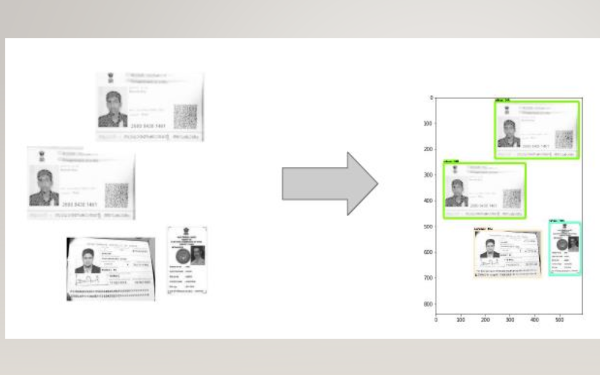

CKYC Legacy Document Classifier & Extractor

It will helps banks/financial organization to met RBI compliance. Using this service clients can process their legacy or new customer KYC document processing to extract OVD like PAN/ Aadhar/ Passport etc from scanned images or pdf files. Using this automation engine millions of documents can process in short time span with an accuracy of 99% in very low quality images also.

Website : http://pixdynamics.com/pixl_classifier_and_extractor.html

Current Status: Steady revenues

Business Model: B2B

Product Description

We are solving a problem on the Legacy CKYC data set which was created before current CKYC implementation. Those data may be unclassified or non segregated. In that case, automated or manual way they process this data with an average of 80%. We are the only service provider to guarantee more than 99% accuracy in this space. There may be millions of billions of data needs to process so that 18% accuracy can lead to huge benefits on RBI Compliance.

Federal Bank

We processed around 200 millions of documents with our PiXL Engine following features with an accuracy of about 99.25 %. CKYC Submission / KYC Documents OVD's Extraction / Verification / Face Extraction from Account Opening Form.

Success Story : The bank was employing RPA the same process but they only able to yield an accuracy 70% accuracy and in situation to not meet RBI compliance, after introduction of PiXL Engine they are getting 99.25% and we successfully achieved their target on this COVID -19 Pandemic time with very minimal manual efforts.

South Indian Bank

We processed around 60 millions of documents with our PiXL Engine - KYC OVD's Extraction features with an accuracy of about 98.5 %.

Success Story : They were doing the same large workforce, after implementing our service they saved 95% time, 75% cost and increased accuracy level to 98.5%.